Interwoven Connections’ Honorarium Policy

Interwoven Connections values the time, expertise, and lived experience of those who contribute to our mission.

This policy outlines how we recognize those contributions through honoraria, ensuring fairness, consistency, and compliance with Canadian nonprofit and tax regulations.

What an Honorarium Is

An honorarium is a discretionary payment that recognizes an individual’s time, effort, or lived experience when contributing to Interwoven activities.

Honoraria are not salaries, wages, or contracts for service, they are voluntary tokens of appreciation for specific, short-term, non-employment contributions such as:

Sharing a lived experience story (e.g. panel participation)

Speaking at a webinar or conference

Providing training

Advising on program or policy development

Participating in co-design sessions, consultations, focus groups

Reviewing materials or providing expert feedback

Eligibility

Honoraria may be offered to:

Families, caregivers, adoptees, kinship and customary caregivers, community members, professionals, Knowledge Keepers and Indigenous Elders

Community partners, or guest speakers not employed by Interwoven

Advisory committee or community of practice and working group members who volunteer their time

Honoraria are not provided to:

Current Interwoven staff or Board members

Individuals being paid under an existing service agreement or contract

Professionals who are sharing/amplifying a for-profit endeavor

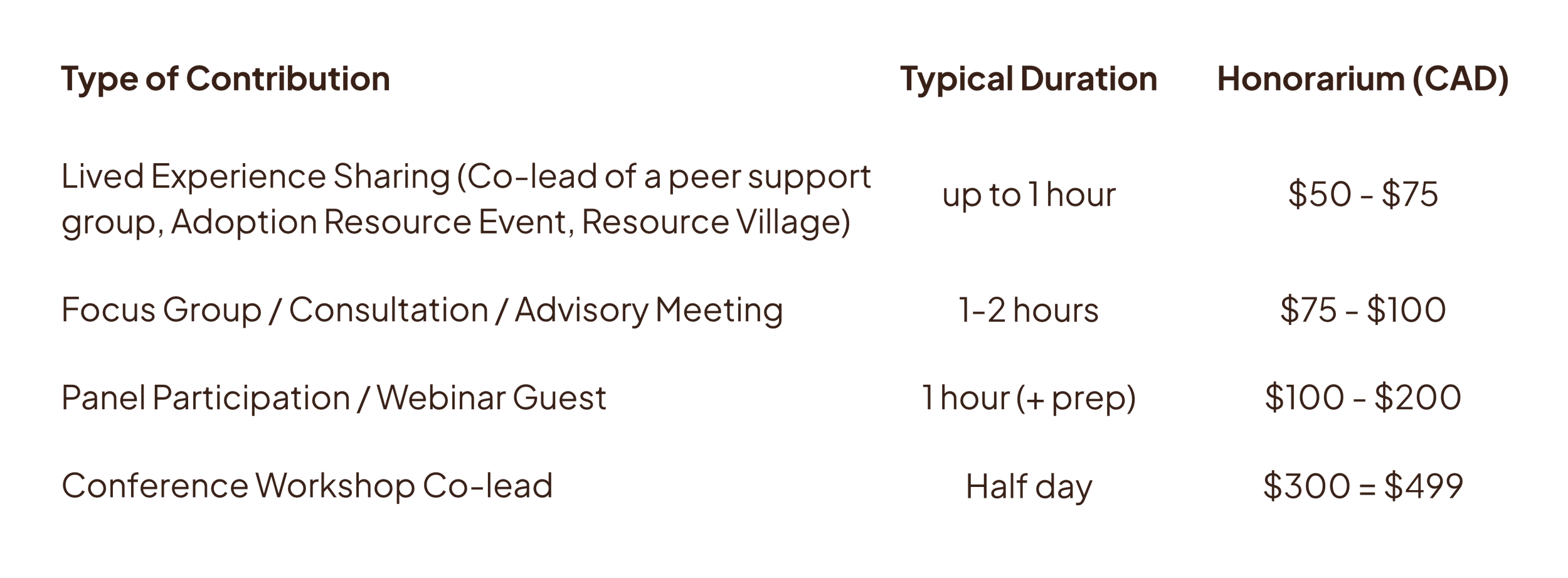

Amounts and Tiers

Amounts are intended as general guidelines and can be adjusted based on activity, scope, preparation required, and available budget.

These are benchmarked against comparable peer Canadian nonprofits and sector guidelines:

Payment:

Payments are typically issued within 30 business days of completion

Payment methods may include e-transfer, or direct payment

Notes:

Amounts and ranges reflect specialized expertise, bilingual delivery, or equitable recognition of lived experience from individuals with multi-layered identities, and underrepresented communities

Accessibility supports required to participate may be considered for reimbursement

Participants may decline or request alternate recognition (e.g., donation in lieu)

Tax and Reporting

Honoraria are considered taxable income per the Income Tax Act of Canada

Interwoven will issue a T4A slip for total annual honoraria exceeding $500

Monetary and non-monetary payments are treated the same for reporting purposes

Individuals receiving income-tested benefits (e.g., ODSP, CPP-D) are encouraged to check how payments may affect their benefits before accepting

Conflict of Interest and Confidentiality

Individuals who receive honoraria must declare any real or perceived conflicts of interest. If you have any questions about a conflict of interest, please email us.

Refer to Interwoven Connections’ Employee Manual for how current employees should consider an offer of an Honorarium from an external partner or community agency.

Review and Accountability

This policy will be reviewed every two years to ensure continued alignment with CRA requirements, funding guidelines, and best practices in the nonprofit sector.

Contact

For questions about honoraria, contact: marketing@interwovenconnections.ca

Last updated: October 16, 2025